Industry News

US Slams China with 104% Tariffs: Survival Strategies for Businesses in the Crossfire

Times:2025-04-18 Views:131

I. Impact on China's Foreign Trade

(A) Short-term Impact

-

Soaring Export Costs and Business Survival PressureThe US is China's third-largest trading partner, with exports to the US accounting for 14.6% of China's total exports in 2024 (Source: International Business Daily). After the tariffs are imposed, industries highly dependent on the US, such as electronics, machinery, and textiles (e.g., over 25% of US imports in the computer electronics sector are from China), will face surging costs. For example, if Apple passes the tariff costs onto consumers, prices could rise by 40% (Source: Global Times), leading to lost orders or squeezed profits.

-

Supply Chain Restructuring and Global Industrial Chain Decoupling US demands for "friend-shoring" and "near-shoring" may accelerate the relocation of supply chains from China to places like Vietnam and Mexico.

-

Trade Deficit and Balance of Payments PressureUS tariffs might lead to a decrease in China's exports to the US, but China's imports from the US will also contract due to higher tariffs (e.g., the cost of importing cars surged by 124%) (Source: China Daily Net), so the trade deficit may not necessarily widen significantly. However, a global trade slowdown could put depreciation pressure on the Renminbi (RMB). While this might temporarily boost export competitiveness, it could exacerbate the risk of capital outflows.

(B) Long-term Opportunities

-

Forcing Industrial Upgrading and Domestic Demand Expansion Tariff pressure will accelerate the transformation of Chinese enterprises towards high-value-added sectors.

-

Trade Diversification and Deepening Regional Cooperation China has already reduced its dependence on the US through platforms like RCEP (Regional Comprehensive Economic Partnership) and the "Belt and Road" initiative.

-

Enhanced Influence in Global Rule-Making The US's unilateral tariff policy has drawn international opposition, with allies like the EU and Canada initiating countermeasures.

II. Analysis of Pros and Cons

(A) Pros

- Accelerated industrial upgrading: Elimination of low-end capacity, enhanced competitiveness in high-end manufacturing (e.g., AI, new energy).

-

Activated domestic market: Shift from exports to domestic sales drives consumption upgrades; rise of new formats like cross-border e-commerce and the digital economy.

- Enhanced supply chain resilience: Diversifying market risks through the "Belt and Road" and regional cooperation.

- Reshaping international rules: Weakening US hegemony, increasing China's influence within frameworks like the WTO and RCEP.

(B) Cons

- Short-term economic pain: Layoffs and bankruptcies in export enterprises; youth unemployment could rise by 0.4 percentage points.

- Risk of technological decoupling: Increased US restrictions on semiconductors, AI, etc., intensifying pressure for technological self-reliance.

-

Global economic volatility: Trade contraction could trigger global stagflation, hindering the recovery of China's external demand.

- Pressure on exchange rates and capital flows: RMB depreciation could stimulate inflation, increasing the risk of capital outflow.

III. Likelihood and Sustainability of the Policy

(A) Policy Implemented, but Long-term Doubts Exist

-

US Domestic Resistance:

- Economic Costs: The US stock market plunge led to nearly 50 trillion RMB in evaporated market value (Source: Sina Finance), annual household spending increased by $5,000 (Source: Jingbao Wang), and unprecedented consumer protests involved over a million people in 1400 demonstrations.

- Corporate Pushback: Multinational corporations like Apple and Tesla faced stock plunges due to tariff costs and supply chain disruptions, increasing lobbying pressure.

- Political Fallout: Trump's "reciprocal tariff" policy provoked opposition from allies (like the EU and Canada), potentially increasing his domestic political isolation.

-

China's Countermeasures and International Pressure:

-

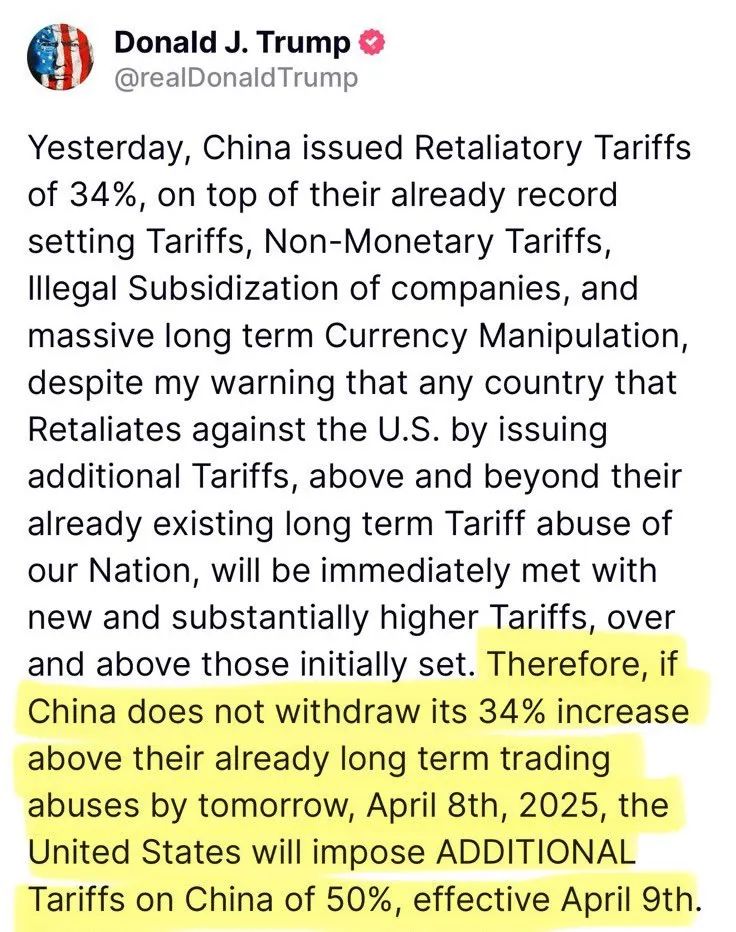

China imposed 34% retaliatory tariffs on US goods and restricted rare earth exports (Source: China Daily Chinese Network), directly impacting US agriculture and high-tech industries (e.g., 80% reliance on China for lithium batteries) (Source: China.org.cn).

-

China imposed 34% retaliatory tariffs on US goods and restricted rare earth exports (Source: China Daily Chinese Network), directly impacting US agriculture and high-tech industries (e.g., 80% reliance on China for lithium batteries) (Source: China.org.cn).

(B) Possible Adjustments

-

Partial Exemptions or Negotiated Compromises: The US might exempt goods like pharmaceuticals or critical components from tariffs, or reduce rates through negotiations.

- Phased Implementation: Implementing tariffs on some goods first, then expanding based on observed effects.

- Domestic Subsidies: The US might provide subsidies to affected businesses to cushion the tariff impact.

(C) Policy Sustainability Assessment

- Short-term: The policy is in effect, and US-China friction might intensify, but both sides have room for negotiation.

- Mid-term: If the risk of a US economic recession increases, Trump might adjust the policy to seek re-election.

- Long-term: The trend of global supply chain "decoupling" is difficult to reverse, but complementarity between the US and China in basic goods trade still exists.

Conclusion:

Trump's tariff policy presents both "crisis and opportunity" for China's foreign trade: short-term impacts are unavoidable, but long-term, it will accelerate China's industrial upgrading and trade diversification. The policy's realization likelihood depends on the intensity of US-China confrontation, US domestic political pressure, and the international community's reaction. China needs to respond with the following strategies:

- Accelerate Technological Self-Reliance: Increase R&D investment in fields like semiconductors and AI to reduce dependence on US technology.

-

Deepen Regional Cooperation: Utilize RCEP and the "Belt and Road" to expand into emerging markets and reduce the proportion of exports to the US.

-

Expand Domestic Demand: Counteract declining external demand through consumption stimulus policies and new infrastructure investment.

-

Strengthen International Coordination: Unite with the EU, ASEAN, etc., to resist unilateralism and uphold the multilateral trading system.

Overall, China has demonstrated strong resilience, but if the US maintains high tariffs long-term, the global economic landscape will face profound restructuring.